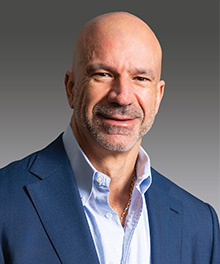

Michael Saccomanno

CPA*, ABV, CFF, CVA

*Licensed by the State of New Jersey

Partner-in-Charge, Valuation, Forensic

& Litigation Services - New York Region

Advisory

About Michael

Michael Saccomanno is the New York Region Partner-in-Charge of Marcum’s Valuation, Forensic & Litigation Services group. He has dedicated more than 15 years to the forensic accounting field, with a concentration in business valuations, dispute resolutions, economic mediations, and fraud investigations.

Michael works with public and private clients in a range of industries, including manufacturing/distribution, technology, and insurance, among others. He is routinely engaged by the area’s top attorneys and appointed by various courts to analyze, investigate, report on and/or mediate financial disputes involving individuals and corporations.

Professional & Civic Affiliations

- American Institute of Certified Public Accountants

- Certified Public Accountant (CPA), Licensed in New Jersey 1998

- Accredited in Business Valuation (ABV), 2005

- Certified in Financial Forensics (CFF), 2008

- New Jersey Society of CPAs (NJSCPA)

- NJSCPA Business Valuation, Forensic & Litigation Services Interest Group

- Institute for Divorce Financial Analysts (IDFA)

- New Jersey Divorce Service CPA’s Group

- National Association of Certified Valuation Analysts (NACVA)

- Certified Valuation Analyst (CVA), 1999

- Elected to Standards Board, June 2018 through May 2021

- Chair of the Litigation Subcommittee of the Standards Board

- Practical Collaborative Solutions, LLC

- Basic Interdisciplinary Collaborative Family Law Training

Articles, Seminars & Presentations

- “Business Development,” Marcum VFLS CPE Series, August 2023

- “Ethical Communication with Clients, Former Clients, and Experts,” NJAJ Boardwalk Seminar, April 2023

- “Preparing An Expert For Testimony,” Marcum Webinar Series, April 2023

- “Synergistic Value in Corporate Mergers,” Contributing Author, AAML NJ Blog, February 202

- “Current Considerations In Business Valuations” Burlington County Bar Association, December 2022

- “Criminal Law from Key West – The Use of CPA’s in Criminal Cases” NJSBA Mid-Year Meeting, November 2022

- “Preparing An Expert For Testimony,” AAML, August 2022

- “Hot Tips for Hot Litigators – Preparing An Expert For Testimony,” NJSBA Annual Meeting, May 2022

- “Business Valuations Post Covid-19: Where We Are and Where We are Going: AAML Seminar, January 2021

- “Business Valuations During the Pandemic – The Impact of Covid-19”, NJAJ Boardwalk Seminar 2020, August 2020

- “Calculation Reports in a Litigation Setting”, NACVA’s Around the Valuation World, July 2020

- “Finding Hidden Assets”, Camden County Bar Association, December 2019

- “Direct and Cross Examination of a Business Valuation Expert”, Thomas Forkin Family Law Inns of Court, November 2019

- “Friedman, LLP’s 2nd Annual Business Leadership Forum, the Impact of Fraud on Business”, Haddonfield New Jersey December 2018

- “Equitable Distribution and Changes in the New Tax Code,” Family Law Certification Exam Prep Course, New Jersey Institute for Continuing Legal Education, New Brunswick, October 2018

- “Hidden Assets and Income in Divorce Cases,” American Bar Association (ABA) Annual Conference, Chicago, August 2018

- “The New Tax Code and Its Impact on the Matrimonial Practice,” NJSBA Annual Conference, Borgota, Atlantic City, May 2018

- “Nuts and Bolts of Business Valuation in Shareholder and LLC Member Disputes,” New Jersey Association of Justice Boardwalk Seminar, May 2018

- “The New Tax Code and Its Impact on the Matrimonial Practice,” Friedman LLP Forsgate Country Club, March 2018