The Key to Reliable Financial Reporting: IT Assurance

By Robert Coro, Partner, Advisory Services

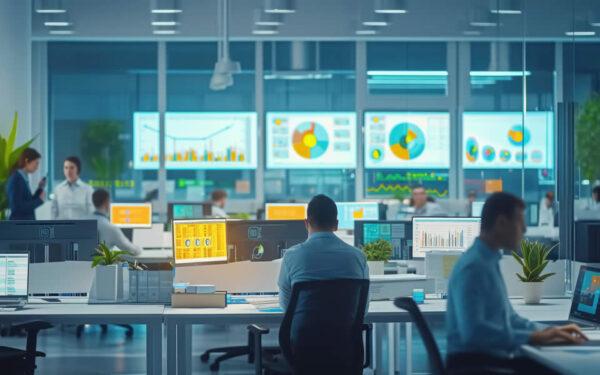

Whether a company is public or private, reliable reporting is imperative for a business. To ensure your business is on stable financial footing, it’s essential to know where you stand, which means reports must be accurate, efficient, and available as necessary.

The role of information technology (IT) in financial reporting is evolving as rapidly as your IT environment, so it is critical to understand its relationship to reporting. Here are key steps to ensure your IT assurance initiatives support your financial reporting needs.

Step One: Understand IT Assurance

IT assurance refers to the processes and controls that your business relies on to assess and manage the risks associated with IT systems and infrastructure. It’s broad-ranging, encompassing activities such as risk assessment, control evaluation, and compliance monitoring. The primary goal of IT assurance is to provide confidence in the reliability, security, and integrity of financial information.

Step Two: Importance of IT Assurance in Financial Reporting

- Accuracy and Reliability: The components that makeup IT assurance (risk assessments, control evaluations, and compliance monitoring, as outlined above) play a vital role in maintaining the accuracy and reliability of financial reports. Users can have confidence in the information presented by ensuring that the underlying IT systems and processes are robust and reliable. That means critical information isn’t siloed unnecessarily, isn’t susceptible to manipulation or loss, and is available to key users who need access to update and maintain data.

- Data Integrity: IT assurance helps safeguard the integrity of financial data. Effective IT assurance requires the implementation of sophisticated controls to prevent unauthorized access, data manipulation, or fraudulent activities. This helps in maintaining the trustworthiness of financial reports.

- Compliance and Regulatory Requirements: Financial reporting is subject to various regulations and compliance standards. IT assurance helps organizations meet those requirements by ensuring appropriate controls are in place to protect sensitive financial data and comply with relevant laws.

Step Three: Key Components of IT Assurance

Generally, implementing processes that bolster IT assurance is a three-stage process repeated regularly over a business’ lifecycle. The stages of IT assurance include:

- Risk Assessment: Assessing IT-related risks is a crucial step in IT assurance. It involves identifying potential vulnerabilities, evaluating the impact of risks, and implementing controls to mitigate them. Regular risk assessments help organizations stay proactive in addressing emerging threats.

- Control Evaluation: Effective IT assurance requires evaluating the effectiveness of the internal controls implemented within IT systems. This includes assessing the design and operating efficacy of controls to ensure they adequately mitigate risks.

- Monitoring and Testing: Continuous monitoring and testing of IT controls is essential in ensuring their ongoing effectiveness. Monitoring and testing include periodic reviews, audits, and vulnerability assessments to identify any weaknesses or gaps in the IT infrastructure.

Step Four: Benefits of IT Assurance for Users of Financial Reports

IT assurance is a significant undertaking, but the results can be well worth the effort and expense. IT assurance programs can enable:

- Increased Confidence: Strong IT assurance processes can enable users of financial reports to enjoy increased confidence in the accuracy and reliability of the information presented in their reports. This, in turn, helps key stakeholders make informed decisions based on trustworthy financial data.

- Mitigating Risks: IT assurance helps identify and reduce IT-related risks that could impact the integrity of financial reports. Organizations can more effectively prevent potential financial losses or reputational damage by proactively addressing these risks.

- Regulatory Compliance: Compliance with regulatory requirements is crucial for financial reporting. IT assurance ensures that organizations are aware of and able to meet strict compliance standards, reducing the risk of penalties and minimizing legal risks associated with noncompliance.

IT assurance is a critical aspect of financial reporting. By understanding its importance and impact, businesses can implement financial reporting processes that support better decision-making, maximize the advantages of their technology, and protect their sensitive information, all while preventing the penalties associated with various forms of noncompliance.